All I want for Christmas…

In the lead-up to Christmas, many retailers are seeing toys fly off their shelves as this is peak time. This is not the case all year round. However, for those of you who may have popped into the same shop for a child’s birthday present at another time, you will have seen there was still plenty to choose from all year round.

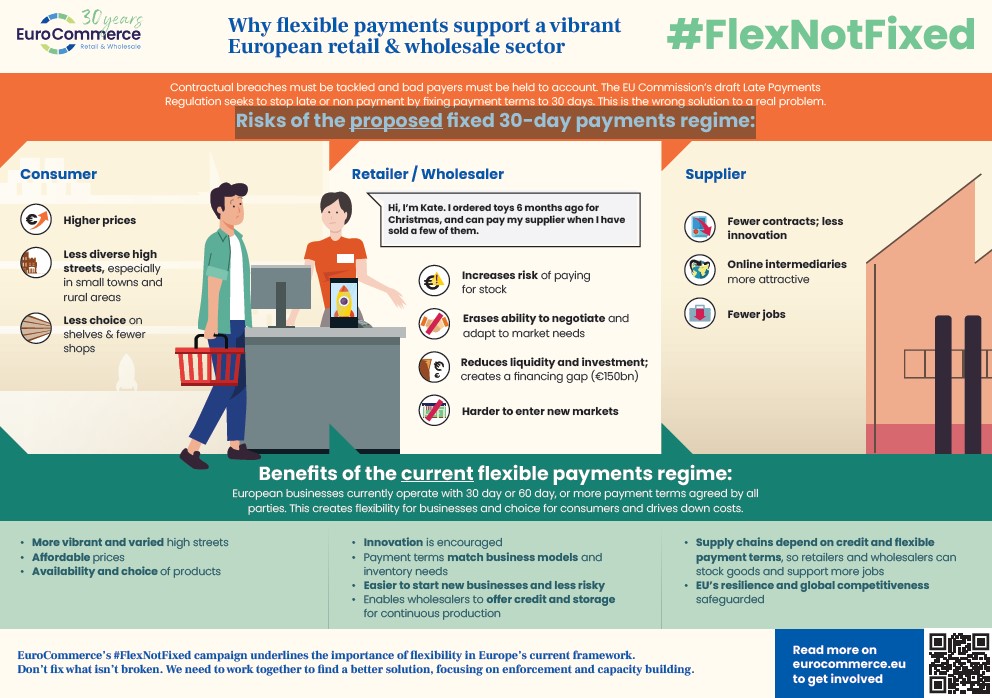

To have a large choice of products, toy retailers agree on payment terms for products that match how quickly they think they will make sales and those negotiations help them offer choice and affordable prices all year round. Such negotiations are common across all types of retail and wholesale to help ensure stores can sell the products the customer wants, and ensure they get it when and where they want to. It especially helps provide local, niche, and innovative products, products that respond to seasonality, those that may have a long-life shelf or are expensive, or react to unexpected shocks like natural disasters, war, and pandemics.

This flexibility is not one-sided. It offers all types of businesses in the economy mutually agreeable conditions that help manage the production, ordering, delivery, and selling of products with predictability for both sides (e.g. ensuring a supply of skis for the winter, and availability of DIY or sports equipment that may take a while to sell).

The flexibility also means wholesalers can support their business customers through supplier credit. For toys, the wholesaler can offer storage for the manufacturer who can produce toys all year round so that when the Christmas period starts, business customers find what they need – avoiding shortages, bottlenecks and stopping manufacturers rushing production to meet the demand at the last minute. Wholesalers also support their business customers by helping for example, a tradesperson place an early order for equipment such as heat pumps to match delivery with the planned installation date, knowing storage and payment flexibility are available in case of delays.

What is set to change?

The Commission’s proposal for a Late Payment Regulation removes the flexibility to negotiate payment terms. It would require payment after 30 days or less. Nothing longer can be agreed even if wanted.

In our video here a French toy store owner explains what the new Late Payments Regulation would change in terms of choice and fewer opportunities for smaller, lesser-known manufacturers, and newcomers, and how larger manufacturers are set to gain.

What affects retailers, affects consumers and also has consequences for wholesalers and suppliers. In our video below a French toy supplier explains what she stands to lose, including higher costs for storage, logistical difficulties and the impact on jobs.

What comes next?

Reducing all payment terms from what they are now down to 30 days creates a cashflow gap. This will need to be filled and will need to come from the banks. For retailers, the cash flow gap is conservatively estimated as between €100-€150 billion.

Absorbing the cost of finance will be difficult, as with low margins (typically 1-3% in food, 4-6% in non-food) retailers and wholesalers will not be able to buffer consumers from the increased costs. This will be felt in their pockets. The alternatives will make retailers focus on what sells best and shift to more costly models such as just-in-time which make them vulnerable to competition, particularly from online intermediation usually between non-EU suppliers and EU consumers.

Changing to models such as consignment, contracting using retention of title or complicated arrangements based on the deposit of goods, is a bad deal for suppliers and buyers. It removes transparency and unnecessarily introduces complexity. It limits entrepreneurship, freedom to decide a pricing strategy and differentiation. Agency as well as consignment in particular means that a supplier will only get paid when a sale is made – which may be much longer than what they may have agreed as a payment term. It is also an odd outcome, encouraging companies to find a workaround to make the legislation work in practice. Policymakers are trying to solve a problem that this regulation is creating!

This infographic shows the risks and benefits of the proposed vs the current legislation.

The stark reality is that many businesses will no longer be economically viable. Their closure will be felt in the diversity of retail and wholesale and in local job markets, in town centres and rural areas. This will also have ripple effects for other value chain actors from manufacturers to logistics that work with our sector daily. And it will affect the availability of products in your local toy store for Christmas, as well as many other areas.

In this video below, this electronics retailer explains the impact that he will feel in Italy.

What we need to have fixed

None of the consequences set out above seem related or proportionate to the objective pursued. The objective is to improve compliance with contracts. What is on the table will remove flexibility and efficiency.

This is why we launched our #FlexNotFixed campaign advocating for freedom of contract and the freedom to negotiate payment terms.

There needs to be parameters for negotiating payment terms. These should require payment in 30 days for perishable food with SME suppliers, payment in up to 60 days for non-perishable food with SME suppliers, and the ability to negotiate (freedom of contract) to agree mutually beneficial arrangements for other goods above 60 days.

To tackle the real problem of late payment, the focus should be on capacity building, including mediation, and enforcement. There are numerous ways that this can be explored in the Regulation and alongside it. This is what should be being discussed, not dramatic changes that risk the affordability, choice and proximity retailers and wholesalers provide to consumers, the chance for them to invest and innovate, and the contribution they make to communities and local jobs.

Visit our #FlexNotFixed campaign here for more details!

Leena Whittaker

Director, Competitiveness

Leena is EuroCommerce’s Director of Competitiveness coordinating advocacy on retail and wholesale ecosystem competitiveness. She is British and has a practical knowledge of EU policy-making from her experience as a legal and policy officer in the European Commission (DG GROW) and is a qualified UK lawyer.