2024 was a year of mixed emotions for European grocers. Volume grew again, albeit slowly, some consumer segments traded up, and AI has been creating value for some grocers. Now, looking ahead to 2025, cost pressure remains high, some supply chains are highly volatile, and many shoppers are still cautious as economic pressure persists.

The questions we hear from grocery executives mirror the mixed picture of 2024: How can grocers attract the more affluent shoppers as well as those whose price sensitivity remains high? What will the shopper of tomorrow look for? Where are the most attractive pockets of growth? How can opportunities from sustainability be captured? Finally, how can grocers benefit from data and AI most effectively?

While the future remains uncertain, we have created a rich fact base to help leaders in European grocery retail navigate the coming years. For this report, we surveyed more than 14,000 consumers and over 30 grocery executives from more than a dozen countries across Europe. Additionally, we interviewed four grocery CEOs. The interviews, surveys, and analyses were conducted in early 2025.

Developments regarding possible tariffs or other trade restrictions that unfolded in March 2025 are not reflected in the report.

To mark the fifth anniversary of The State of Grocery Retail Europe publication, we have added various new features, including a five-year outlook, a data-driven analysis of the signature practices of successful grocers, and a proprietary volume growth model to inform the assessment of growth opportunities in different parts of Europe.

Once again, we combined our policy and sector knowledge with McKinsey’s global expertise and analytical rigor. We hope this report will offer new insights and perspectives to help European grocers navigate ongoing uncertainties and seize future growth opportunities.

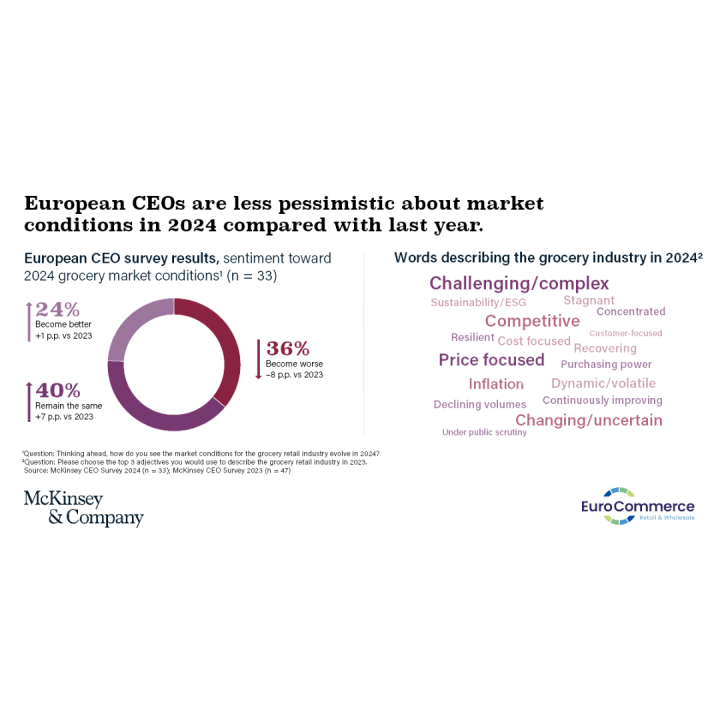

In 2025, the recovery is expected to gain momentum. Grocery retail CEOs in Europe are slightly more optimistic than they were last year. Nevertheless, the next few years are expected to remain challenging, with low volume growth and sustained pressure on profitability. To thrive in this competitive landscape, grocers could double down on pockets of growth through differentiation, focus on execution efficiency, meet the needs of the consumer of the future, and leverage data, AI, and technology.